The decision to buy a house is one of the most significant financial choices one can make. With the real estate market constantly evolving, potential homebuyers often find themselves pondering a crucial question: Is it a good time to buy a house? In this blog post, we’ll delve into the current real estate landscape and provide insights to help you make an informed decision.

Understanding Market Trends

Real estate markets are influenced by various factors, including economic conditions, interest rates, and local supply and demand. Here are some key considerations:

-

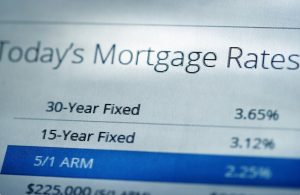

Interest Rates: One of the primary factors influencing the decision to buy a house is the prevailing interest rates. Lower interest rates generally mean more affordable mortgages, potentially making it an opportune time to enter the market.

-

Market Inventory: Take a look at the current housing inventory in your desired location. A limited supply and high demand can drive prices up, while a surplus of available homes may offer more negotiating power for buyers.

-

Economic Stability: Consider the overall economic stability of the region. A strong economy often correlates with a robust real estate market.

Advantages of Buying in the Current Market

-

Historically Low Interest Rates: As of [current date], interest rates remain historically low, providing an excellent opportunity for homebuyers to secure favorable financing terms.

-

Potential for Equity Growth: Real estate has the potential to appreciate over time, allowing homeowners to build equity. Buying a house now could position you for future financial growth.

-

Stable Housing Payments: Owning a home provides stability in housing payments compared to renting, where rent prices may increase over time.

-

Personalization and Long-Term Investment: Homeownership allows you to personalize your living space and is often considered a long-term investment.

Considerations for Prospective Buyers

-

Financial Preparedness: Assess your financial situation, considering factors such as credit score, debt-to-income ratio, and savings for a down payment.

-

Future Plans: Evaluate your long-term plans and whether homeownership aligns with your lifestyle and goals.

-

Consult with Professionals: Speak with mortgage experts and real estate professionals to gain insights into the local market and financing options.

Conclusion: Your Decision, Your Timeline

Ultimately, the decision of whether it’s a good time to buy a house depends on your individual circumstances, market conditions, and personal goals. If you’re financially prepared, have considered the market trends, and foresee homeownership as a positive step, now could be the ideal time to embark on this exciting journey.

At My Mortgage Company, we’re here to guide you through the homebuying process. Our team of experts can help you explore financing options and navigate the current real estate landscape. Whether you’re a first-time buyer or looking to upgrade, we’re dedicated to making your homeownership dreams a reality.

If you have any questions or would like personalized advice, feel free to contact us. It’s your journey, and we’re here to help you every step of the way. Happy house hunting!