Understanding Fixed and Variable Rate Mortgages

Purchasing a home is one of the most significant financial decisions you’ll ever make, and choosing the right mortgage is crucial to your long-term financial well-being. Among the various mortgage options available, fixed-rate and variable-rate mortgages stand out as two popular choices. In this blog post, we’ll explore the features, benefits, and considerations of each to help you make an informed decision that aligns with your financial goals.

1. Fixed-Rate Mortgages: Stability in Payments

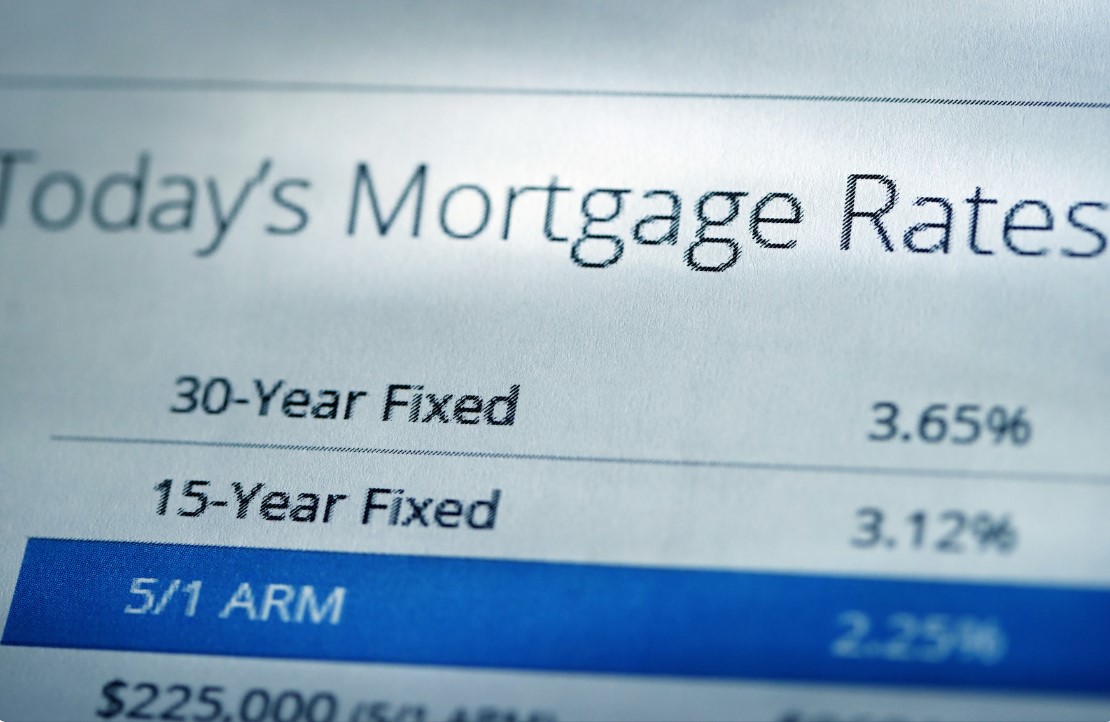

Overview: A fixed-rate mortgage is characterized by a stable interest rate that remains constant throughout the entire loan term. This means that your monthly mortgage payments remain consistent, providing predictability and ease of budgeting.

Benefits:

-

Payment Stability: Your principal and interest payments stay the same, offering financial predictability over the life of the loan.

-

Long-Term Planning: Ideal for those who prefer long-term financial planning and want to avoid fluctuations in their monthly budget.

-

Rate Lock: Protect yourself from market volatility by securing a fixed interest rate, shielding you from potential interest rate hikes.

Considerations:

-

Potentially Higher Initial Rates: Fixed-rate mortgages may have slightly higher initial interest rates compared to the introductory rates of variable-rate mortgages.

-

Limited Short-Term Savings: If interest rates decrease after securing a fixed-rate mortgage, you won’t immediately benefit from lower rates.

2. Variable Rate Mortgages: Riding the Market Waves

Overview: Variable rate mortgages, also known as adjustable-rate mortgages (ARMs), feature interest rates that can fluctuate over time based on changes in the market index.

Benefits:

-

Lower Initial Rates: Variable rate mortgages often have lower initial interest rates, providing potential short-term savings.

-

Market-Linked Rates: The interest rate is linked to market conditions, allowing borrowers to benefit from decreases in interest rates.

-

Potential for Lower Overall Costs: If interest rates remain stable or decrease, you could pay less over the life of the loan compared to a fixed-rate mortgage.

Considerations:

-

Payment Fluctuations: Monthly payments can increase or decrease based on market conditions, leading to potential budget uncertainty.

-

Interest Rate Caps: ARMs typically have rate caps to limit how much the interest rate can increase during specified periods, but it’s essential to understand these terms.

-

Risk of Increasing Rates: If market interest rates rise, your mortgage interest rate and monthly payments could increase.

Choosing the Right Mortgage for You

Ultimately, the choice between a fixed-rate and variable-rate mortgage depends on your financial situation, risk tolerance, and future plans. Consider factors such as your desired level of payment stability, your comfort with market fluctuations, and your long-term financial goals.

If you’re uncertain about which mortgage type suits your needs, consult with a reputable mortgage advisor. They can provide personalized guidance based on your unique circumstances, helping you make a confident decision that aligns with your homeownership journey. Remember, a well-informed choice today can lead to financial peace of mind tomorrow.