Are you ready to take the exciting plunge into homeownership? As a first-time buyer, the prospect of purchasing your own home can be both thrilling and a bit overwhelming. To guide you through this significant life milestone, we’ve compiled a set of valuable tips to help you make informed decisions and embark on your homeownership journey with confidence.

1. Assess Your Financial Readiness

Before diving into the housing market, take a close look at your finances. Establish a clear budget, considering your income, monthly expenses, and potential homeownership costs like mortgage payments, property taxes, and insurance. Understanding your financial picture will empower you to set realistic expectations and avoid overextending yourself.

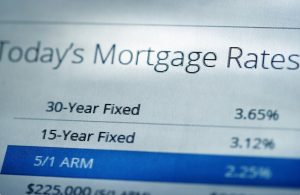

2. Get Pre-Approved for a Mortgage

Gain a competitive edge in the home-buying process by getting pre-approved for a mortgage. This not only gives you a clear understanding of your budget but also signals to sellers that you’re a serious and qualified buyer. Mortgage pre-approval provides a solid foundation for your house hunting journey.

3. Research Neighborhoods and Prioritize Your Needs

Each neighborhood has its unique charm and amenities. Research potential areas, considering factors like proximity to work, schools, public transportation, and local amenities. Prioritize your needs and wants, distinguishing between essential features and desirable extras. This will streamline your home search and help you find the perfect fit.

4. Understand the Total Cost of Ownership

Owning a home involves more than just mortgage payments. Consider additional costs like property taxes, homeowners insurance, maintenance, and utilities. Factoring in these expenses will ensure you’re prepared for the full scope of homeownership costs and can maintain a comfortable financial balance.

5. Work with a Knowledgeable Real Estate Agent

A seasoned real estate agent can be an invaluable ally for first-time buyers. Choose an agent with experience in your desired market, as they can provide insights, negotiate on your behalf, and guide you through the complex process of purchasing a home. Their expertise will prove invaluable in making informed decisions.

6. Attend Homebuyer Education Programs

Many communities offer homebuyer education programs designed to educate and empower first-time buyers. These programs cover topics such as the homebuying process, mortgage options, and financial planning. Attending these sessions can boost your confidence and equip you with the knowledge needed to navigate the real estate market.

7. Be Patient and Stay Flexible

The journey to homeownership may involve twists and turns. Be patient and stay flexible, understanding that finding the right home may take time. Don’t be afraid to explore different options and adjust your expectations. The perfect home for you is out there, and patience is key in the search process.

Conclusion: Your Path to Homeownership

Buying your first home is a monumental achievement, and with careful planning and informed decision-making, you can make the process smoother and more rewarding. By following these essential tips, you’ll be well on your way to unlocking the doors of your dream home and embracing the joys of homeownership.

Remember, our team at My Mortgage Company is here to support you throughout your journey. Feel free to reach out for personalized guidance and expert advice. Happy house hunting!